Polygon (formerly known as Matic Network) is a multi-chain scaling solution for the Ethereum blockchain. Designed to provide faster and cheaper transactions, Polygon seeks to address the scalability and usability issues inherent in Ethereum without compromising on its security. Through its “commit-chain” solution, it aids in reducing the complexity of conducting transactions on the main chain by processing them off-chain before finalizing them on the Ethereum mainnet.

The MATIC token, originally introduced for the Matic Network, serves multiple purposes within the Polygon ecosystem, including paying for transaction fees and participating in the network’s proof-of-stake consensus mechanism. With its commitment to ensuring a more accessible decentralized world, Polygon offers tools for developers to create and link various blockchain networks, making it a prominent player in the pursuit of a multi-chain future.

Factors influencing the price of Polygon

The price of Polygon (MATIC) is influenced by a combination of internal factors related to its platform and external factors prevalent in the broader crypto market. Some of the primary factors affecting its valuation include:

- Market Sentiment: Like all cryptocurrencies, the price of MATIC can be significantly impacted by the overall sentiment in the crypto space. Positive news or endorsements can lead to bullish runs, while negative press or regulatory concerns can cause downturns.

- Adoption and Integration: The adoption of Polygon’s scaling solutions by projects, DApps, and platforms plays a crucial role. The more projects that use Polygon for scalability, the more demand there is for MATIC.

- Ethereum’s Performance: Given that Polygon is a scaling solution for Ethereum, the performance, scalability issues, and upgrades (like Ethereum 2.0) on the Ethereum network can influence MATIC’s price.

- Technological Developments: Enhancements in the Polygon network, such as added features, scalability improvements, or security upgrades, can affect its market perception and value.

- Regulatory News: Decisions made by regulatory bodies, especially in significant markets, can impact MATIC’s price. Positive regulations can bolster the price, while negative regulations or potential bans can depress it.

- Network Activity: The number of transactions, DApps, and smart contracts deployed on Polygon can serve as indicators of its utility and value. Higher activity typically indicates a robust ecosystem.

- Competition: There are other scaling solutions and Layer 2 platforms in the space. The rise or updates of competitors can influence MATIC’s market standing.

- Speculation: A large segment of crypto trading is speculative. Traders looking for short-term profits can influence volatility, leading to short-term price spikes or drops.

- Staking and delegation: Polygon uses a proof-of-stake consensus mechanism. The more MATIC tokens staked or delegated in the network, the fewer there are in circulation, which can affect its supply-demand dynamics and thus its price.

- Security: Any vulnerability or security breach associated with the Polygon network can negatively impact investor confidence, leading to potential price drops.

- General Cryptocurrency Market Trends: Broader market trends, such as bull or bear markets in the cryptocurrency space, play a considerable role in determining the price of individual tokens, including MATIC.

- Partnerships and Collaborations: Strategic partnerships with other projects, platforms, or even enterprises can enhance the credibility and adoption of Polygon, thereby influencing its price.

It’s worth noting that the crypto market is notably volatile, and while these factors offer some insights, exact price predictions are inherently challenging.

Polygon Current Price Chart

- MATIC (migrated to POL)

(MATIC) - Price $0.00

- Market Cap$0

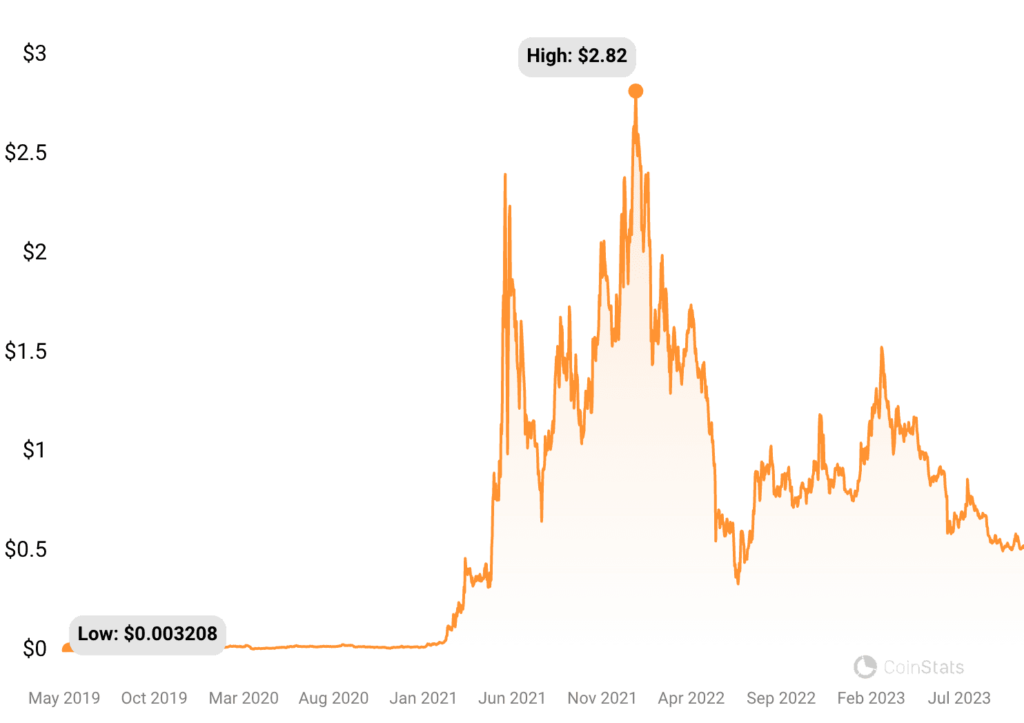

Polygon Price History

Yearly Polygon Price Prediction Table 2023–2030

The Polygon price prediction outlined in the table below for the years 2023–2030 is based on hypothetical values. These forecasts are derived from a blend of contemporary market insights, past trajectory patterns, and an imagined analysis of the Polygon chart.

| YEAR | MINIMUM PRICE | AVERAGE PRICE | MAXIMUM PRICE |

|---|---|---|---|

| 2023 | $0.49 | $0.73 | $1.65 |

| 2024 | $1.55 | $1.15 | $2.28 |

| 2025 | $2.06 | $2.78 | $2.99 |

| 2026 | $2.84 | $3.39 | $3.85 |

| 2027 | $3.62 | $4.11 | $4.72 |

| 2028 | $4.29 | $4.96 | $5.83 |

| 2029 | $5.68 | $6.24 | $7.59 |

| 2030 | $7.36 | $8.19 | $9.93 |

Polygon Price Prediction 2023

For 2023, the hypothetical data suggests a potential high of $1.65, potentially pulling back to a more conservative low of $0.49. Assessing these fictional market dynamics, the anticipated average might settle around $0.73. Polygon’s continuous advancements might make MATIC a coin to watch.

Polygon Price Prediction 2024

The year 2024 could see MATIC traveling between a commendable peak of $2.28 and a foundational $1.55. Averaging these, MATIC might settle at about $1.15. As Polygon’s ecosystem potentially evolves, the crypto community will likely remain engrossed.

Polygon Price Prediction 2025

In 2025, MATIC’s hypothetical range might span from a low of $2.06 to an ambitious peak of $2.99. Striking a balance between these figures could lead to an average price of around $2.78. The adaptability and resilience of Polygon would be at the center of attention in the crypto domain.

Polygon Price Prediction 2026

Navigating into 2026, MATIC might oscillate between an impressive high of $3.85 and a grounded $2.84. Taking the middle ground from these figures, an average price of $3.39 could emerge, underscoring the imagined success of the Polygon platform.

Polygon Price Prediction 2027

Come 2027, the hypothetical data for MATIC portrays a price range between $3.62 at the lower end and a striking $4.72 at its zenith. An average price of about $4.11 might be the narrative, emphasizing the possible advancements and contributions of decentralized applications on Polygon.

Polygon Price Prediction 2028

By 2028, predictions could place MATIC between a conservative value of $4.29 and a remarkable peak of $5.83. Harmonizing these, the digital coin’s value might gravitate towards an average of $4.96, reflecting its projected growth.

Polygon Price Prediction 2029

As 2029 rolls out, MATIC might target a high of $7.59 while possibly staying anchored near $5.68. Considering these hypothetical prices, a consolidated value of roughly $6.24 seems plausible, pointing towards the coin’s imagined potential.

Polygon Price Prediction 2030

Looking ahead to 2030, MATIC’s spectrum in our fictional narrative might spread from a promising $7.36 to an astonishing $9.93 peak. Merging these hypothetical figures, an estimated average of $8.19 emerges, highlighting MATIC’s potential role in shaping the future of multi-chain interoperability.

Discussion about this post