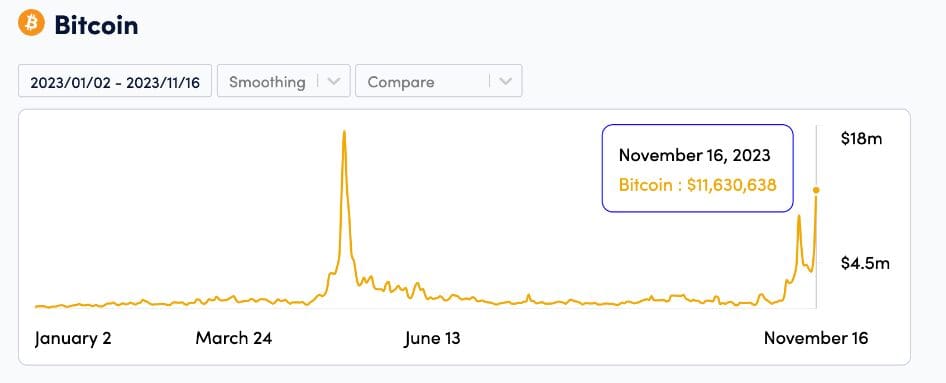

Bitcoin’s blockchain has experienced a staggering surge in transaction fees, reaching a striking $11.6 million on November 16. This dramatic upswing comes alongside an average transaction fee increase of 746% compared to the same period last year. The notable hike in fees signals a fervent demand for the primary cryptocurrency, primarily fueled by the growing anticipation of an approved spot Bitcoin exchange-traded fund (ETF) in the United States.

Unprecedented Surge In Transaction Fees

Statistical data from CryptoFees indicates that Bitcoin’s blockchain hit the $11.6 million milestone in fees on November 16. As of the latest figures from YCharts, the average transaction fee stands at $18.69, marking a staggering 113% spike from the previous day and an extraordinary 746% surge from a year ago.

Bitcoin’s Price Surge And ETF Speculation

Amidst this frenzy, Bitcoin continues to maintain its position near 18-month highs, surpassing its trading range from the bear market. At present, the cryptocurrency is valued at $36,407, reflecting a 0.58% gain in the last 24 hours.

The cryptocurrency’s upward trajectory can be significantly attributed to the growing buzz around the prospect of a spot Bitcoin exchange-traded fund. Notably, Wall Street giant BlackRock initiated the ETF wave by filing for a spot BTC ETF with the Securities and Exchange Commission (SEC) in June. Following suit, various major asset managers in the U.S., such as Fidelity, ARK Invest, WisdomTree, among others, submitted similar proposals.

#Bitcoin has officially flippened ETH in daily fees for the first time in 3 years. pic.twitter.com/2G3t6j64TP

— ₿ Isaiah 58k Gang (@BitcoinIsaiah) November 17, 2023

Also Read: BlackRock’s Bitcoin ETF Filing: Shedding Light on Stablecoin Risks

Regulatory Interactions And Investor Expectations

While the SEC has shown engagement with these firms and their proposals, no final decision has been reached yet. The regulatory body extended the final deadlines for deliberation to January 2024. Recently, several firms, including WisdomTree, ARK, 21Shares, Valkyrie, Bitwise, and VanEck, amended their Form S-1 submissions with the SEC, indicating potential responses to the concerns raised by the regulatory body.

Bloomberg’s senior ETF analyst, Eric Balchunas, highlighted that these amendments suggest a proactive approach in addressing SEC’s concerns. “It means ARK got the SEC’s comments and has dealt with them all, and now put [the] ball back in [the] SEC’s court,” Balchunas mentioned. The amendments signify significant progress in addressing regulatory queries, indicating positive advancements in the approval process.

Spot Bitcoin ETF And Its Significance

A spot Bitcoin ETF essentially mirrors the price movements of Bitcoin by directing the purchase of Bitcoin as the underlying asset. This investment avenue provides investors an opportunity to engage in Bitcoin’s market fluctuations through traditional brokerage accounts, eliminating the need to purchase Bitcoin through crypto exchanges.

The anticipation around a spot Bitcoin ETF potentially attracting institutional capital is high. Analysts at Bloomberg predict a 90% likelihood of approval for all proposals within the same batch in January. This projected approval may potentially drive Bitcoin’s value to new peaks in the forthcoming months.

Discussion about this post