In a landmark decision following years of anticipation, the US Securities and Exchange Commission (SEC) has finally approved a spot Bitcoin ETF, setting off a chain of price movements and increased market volatility. The approval marks a significant development for the cryptocurrency industry, with a decade-long struggle culminating in the regulator’s nod to introduce this financial product to US markets.

Decade-Long Bitcoin ETF Speculation Culminates in SEC’s Move

The journey to the approval of a spot Bitcoin ETF has been one of prolonged speculation and regulatory hurdles. Throughout the beginning of the year, the cryptocurrency industry remained on tenterhooks, with the SEC’s decision becoming a focal point. After years of rejecting and delaying numerous applications, the securities regulator was expected to greenlight a spot Bitcoin ETF at the outset of 2024.

The anticipation surrounding this decision had already introduced a sense of volatility to the market in the preceding week. However, the real action unfolded on January 10, with the SEC officially approving several spot Bitcoin ETFs. The immediate impact on Bitcoin’s price was evident, with the cryptocurrency experiencing a rollercoaster ride. It initially dipped to $44,200, surged to nearly $48,000, and then retraced to just under $46,000. As of the latest update, Bitcoin has stabilized at slightly over $46,000.

Altcoins Shine Amidst Market Turbulence

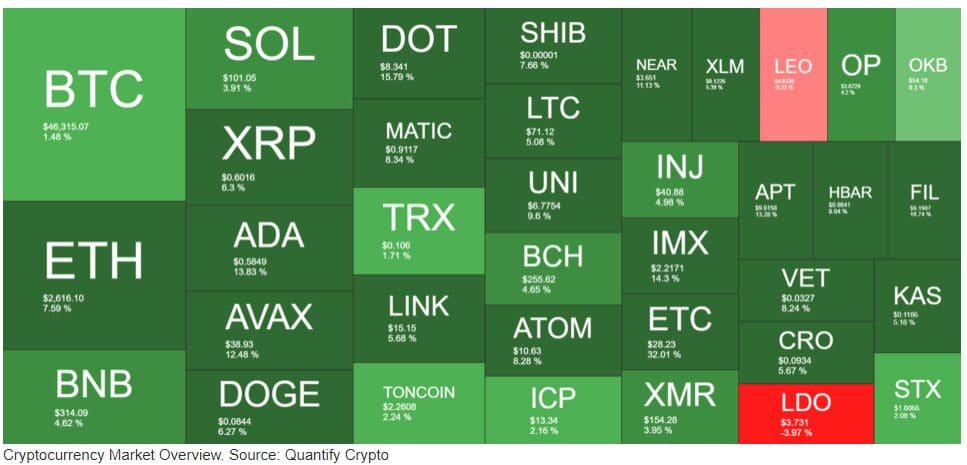

While Bitcoin took centre stage after the SEC’s decision, it’s noteworthy that several altcoins have outperformed the primary digital asset. Ethereum (ETH), in particular, showcased an impressive 8% surge, reaching a 20-month peak of over $2,600. Other altcoins such as Ripple, Dogecoin, Polygon, and Chainlink have also witnessed significant increases in value. Cardano, Polkadot, and Avalanche experienced double-digit surges, with their prices climbing to $0.58, $8.3, and $39, respectively.

The positive momentum extended to lower- and mid-cap altcoins, with notable gains seen in assets like ENS (43%), ETC (31%), SUI (25%), and MNT (25%). The collective impact of these movements has led to an overnight addition of over $50 billion to the total crypto market cap, which now stands at $1.770 trillion.

Market Dynamics and Cautionary Note

As the crypto market experiences these dynamic shifts, investors must exercise caution and conduct thorough research before making any investment decisions. The information provided here is a snapshot of the market’s recent developments, and users are advised to use it at their own risk. A disclaimer emphasizes the importance of individual research and acknowledges the inherent risks associated with cryptocurrency investments.

Discussion about this post