Market Response to CPI Data

The global cryptocurrency market and Bitcoin experienced a downturn following the release of the U.S. Consumer Price Index (CPI) data, which surpassed expectations.

Impact of Unchanged Interest Rates

The decision by the Federal Open Market Committee (FOMC) to maintain interest rates, despite higher inflation rates, led to bearish sentiment in the crypto market.

The global cryptocurrency market, including Bitcoin (BTC), faced a slight decline in response to the latest U.S. Consumer Price Index (CPI) report. The CPI annual rate exceeded expectations, rising from 3.4% to 3.1% while the anticipated rate was 2.9%. Despite this, the Federal Open Market Committee (FOMC) opted to keep interest rates unchanged, currently ranging between 5.25% to 5.50%.

This decision, coupled with the anticipation of a similar stance in the upcoming FOMC meeting on March 20, contributed to a bearish outlook in the cryptocurrency market.

Data from CoinGecko indicates that the global cryptocurrency market capitalization experienced a 0.3% decline in the past 24 hours, now totalling $1.95 trillion. Similarly, Bitcoin saw a 0.8% drop, trading at $49,600 at the time of reporting. The daily trading volume of BTC also decreased by 13%, hovering around $34 billion. Notably, Bitcoin reached an intraday low of $48,470 shortly after the release of the CPI report.

Also Read:Bitcoin Halving 2024: What To Expect And How It Impacts Your Crypto Portfolio

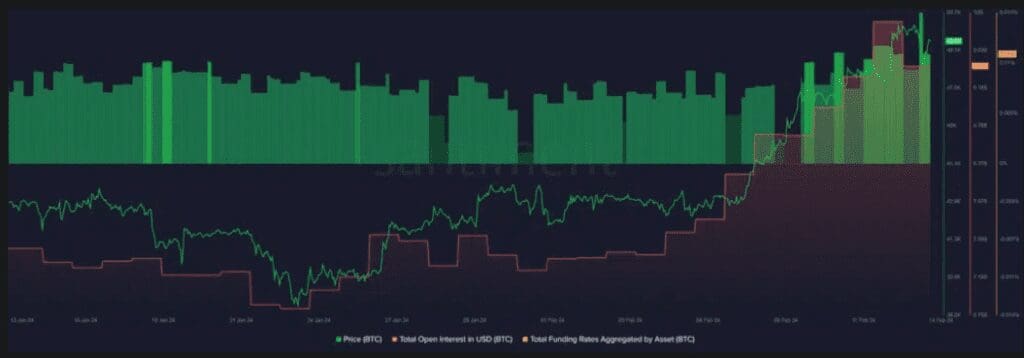

Santiment’s data revealed a decline in Bitcoin’s total open interest (OI) from $9.9 billion to $9.4 billion, indicating a reduction of approximately $500 million. Additionally, the total funding rate from all exchanges decreased from 0.014% to 0.01% post the FOMC meeting, suggesting a decrease in traders anticipating a further price surge, thereby reflecting a prevailing bearish sentiment in the market.

Future Market Expectations

Despite the current market sentiment, Bitcoin option trades expiring on March 29 suggest bullish expectations, with traders speculating on prices reaching new all-time highs, ranging from $60,000 to $75,000, as reported by crypto.news on Feb. 13.

Discussion about this post