Bitcoin’s recent dip to around $49,000 has sparked concerns of a potential bear market, driven by significant macroeconomic changes such as the Bank of Japan’s unexpected interest rate hike and the Federal Reserve’s current stance. This downturn has triggered the Bitcoin bull-bear market cycle indicator, suggesting a possible shift in investor sentiment toward a bear phase.

Historical Accuracy of the Bull-Bear Market Indicator

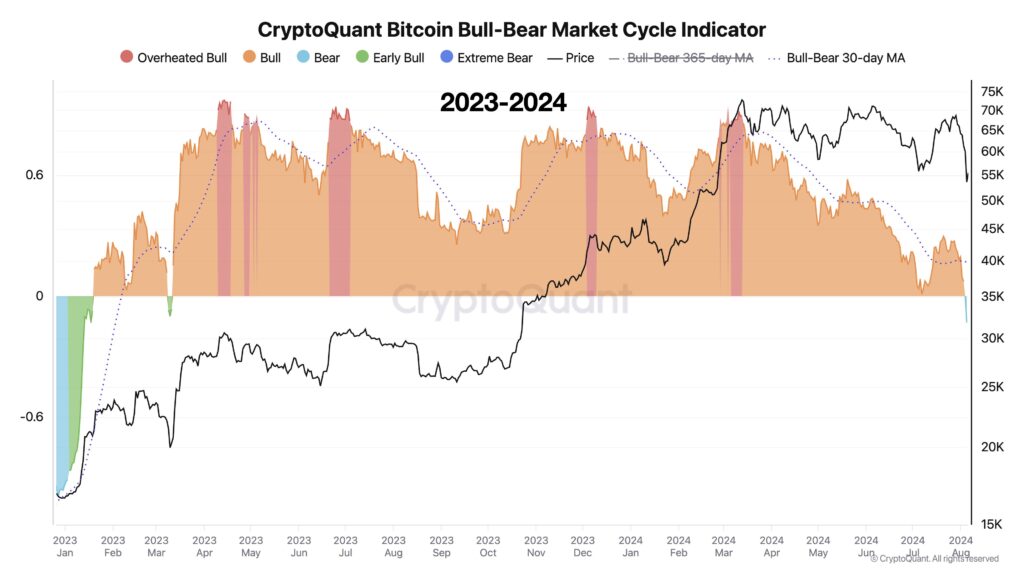

Julio Moreno, head of research at CryptoQuant, noted that this is the first bear signal from the indicator since January 2023, shortly after the collapse of FTX. The bull-bear market cycle indicator has a history of accurately predicting market downturns, including the COVID-19 panic in March 2020, the Chinese government’s mining ban in May 2021, and the onset of the crypto bear market in November 2021.

However, CryptoQuant founder Ki Young Ju advised caution, suggesting that the signal should be monitored for at least two weeks to confirm a sustained bear market phase. Ju remains optimistic, stating that Bitcoin could reach a new all-time high within a year if it maintains a price level above $45,000.

Impact of the Bank of Japan’s Rate Hike

The recent interest rate hike by the Bank of Japan, which marked the end of a 17-year policy of maintaining relatively low interest rates, has been identified as a primary catalyst for the current market turmoil. The rate increase from 0.1% to 0.25% led investors to liquidate their dollar-denominated assets to repay yen-denominated loans, anticipating further rate hikes.

This unwinding of the yen carry trade resulted in over $1 billion being liquidated from the crypto markets, including approximately $367 million in Bitcoin and $350 million in Ether. Despite this significant sell-off, the markets have shown some recovery since August 5.

Market Sentiment and Future Predictions

Traders and analysts are divided on whether the recent downturn is a temporary fluctuation or indicative of a more sustained bear market. Popular long-term crypto trader Jelle cautioned that the third quarter, especially August and September, is traditionally challenging for the Bitcoin market.

Also Read: Potential Crypto Market Surge if Trump Wins the 2024 US Election

Discussion about this post