Bitcoin activity has plummeted to levels not seen since 2010, raising concerns about the current state of the market. Retail investors are shying away, while speculators flock to celebrity meme coins.

Record Low Bitcoin Wallet Activity

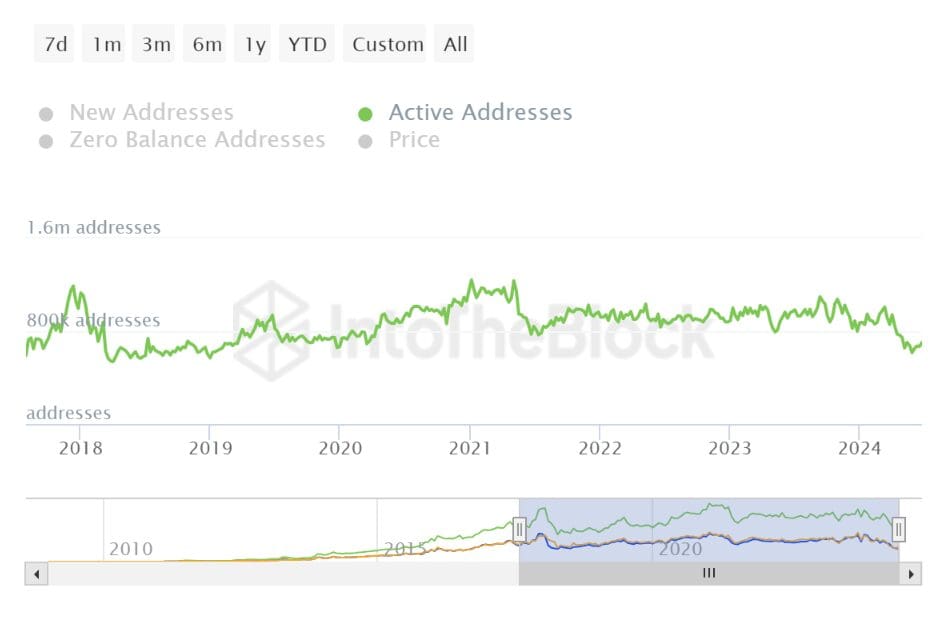

Bitcoin, the world’s first cryptocurrency, is experiencing its lowest activity levels in over a decade. Onchain data from IntoTheBlock reveals that the ratio of active Bitcoin addresses has fallen to its lowest point since November 2010. In June, the weekly active wallet ratio peaked at 1.32%, with a low of 1.22% recorded. This drop signifies a significant decline in buying and selling activities among Bitcoin holders, hinting at a period of market consolidation.

Retail Participation Declines

According to Juan Pellicer, a senior researcher at IntoTheBlock, the decline in Bitcoin wallet activity is primarily due to weaker retail participation compared to previous cycles. This year, the drive to new all-time highs was fueled by institutional capital rather than retail investors. The broader economic situation may have deterred retail investors from making significant crypto investments as they have in the past.

In May, the total number of active wallets dropped to a multi-year low of 614,770, the lowest since December 2018. This decline suggests that fewer individuals are engaging in Bitcoin transactions, whether buying or selling.

Institutional Influence and Whale Movements

The reduction in retail participation coincides with increased activity from institutional investors and large holders, or “whales.” These entities often conduct their transactions off-chain, reducing the impact on onchain address activity statistics. The impending distribution of payments to creditors by the Mt. Gox trustee in July is expected to further influence whale movements.

Impact of Runes and Miner Revenue

The introduction of Runes, a fungible token protocol launched with Bitcoin’s latest halving event in April, was expected to revitalize miner revenue. Initially, it seemed successful as miners earned record-high trading fees on the halving day. However, transaction fees have since normalized to pre-halving levels, and miner reserves are now at a 14-year low.

Pellicer notes that while activity on Runes has cooled, this could be a temporary lull due to the cyclical nature of such assets.

The Shift to Memecoins

While Bitcoin activity dwindles, attention has shifted towards meme coins and celebrity tokens. These assets attract speculators seeking quick profits, diverting interest away from more established cryptocurrencies like Bitcoin. Despite its notorious volatility, Bitcoin’s current market state appears stable compared to the erratic nature of lower-cap meme coins.

Also Read: Meme Coins on the Rise: Inside the $2.4 Million Profit of a Crypto Trader

Conclusion

Bitcoin’s decreased activity levels highlight a significant shift in market dynamics. With retail investors stepping back and institutional players taking the lead, the cryptocurrency landscape is undergoing substantial changes. The rise of memecoins and other speculative assets further underscores the evolving nature of the crypto market. As the industry continues to develop, monitoring these trends will be crucial for understanding Bitcoin’s future trajectory.

Also Read: Bitcoin Price Alert: Why a $50,000 Drop May Precede the Next Bull Market

Discussion about this post