The anticipation surrounding BlackRock’s foray into the cryptocurrency ETF arena has finally been confirmed.

In a significant move, BlackRock, a behemoth in the world of asset management, has submitted a 19b-4 form filing to the United States Securities and Exchange Commission, officially announcing its plans for a spot Ethereum exchange-traded fund (ETF). This filing was facilitated by Nasdaq, representing BlackRock’s pursuit of a proposed ETF named the “iShares Ethereum Trust.”

Expanding Beyond Bitcoin

The emergence of the “iShares Ethereum Trust” marks BlackRock’s determined stride beyond Bitcoin into the world of Ethereum-based investment products. Earlier on the same day, it was revealed that BlackRock had registered the corporate entity “iShares Ethereum Trust” in Delaware, serving as the initial hint that a spot Ethereum ETF filing was on the horizon.

UPDATE: BlackRock #Ethereum ETF confirmed. They just submitted a 19b-4 filing with Nasdaq pic.twitter.com/pLhuhhK7jo

— James Seyffart (@JSeyff) November 9, 2023

BlackRock’s entrance into the Ethereum ETF realm reflects a broader trend of established financial institutions and investment giants recognizing the potential of cryptocurrency-backed ETFs. Over the past few months, several financial firms, including VanEck, ARK 21Shares, Invesco, Grayscale, and Hashdex, have voiced their interest in obtaining approval from the Securities and Exchange Commission (SEC) for a spot Ethereum ETF.

Also Read: ETF Types: Exploring Various Exchange-Traded Funds

Ether’s Rally In Response

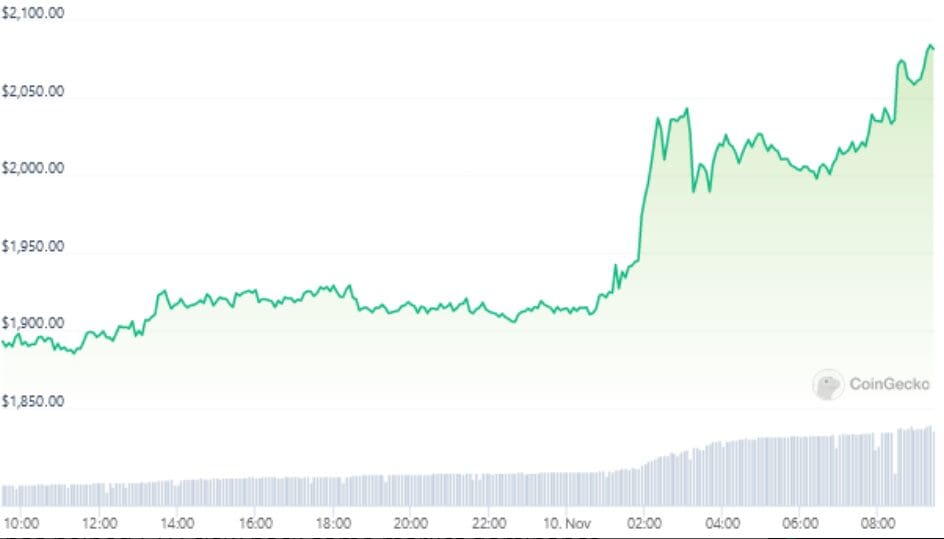

The news of BlackRock’s commitment to the iShares Ethereum Trust sent ripples through the cryptocurrency market, especially in the realm of Ethereum (ETH). ETH experienced a notable 8.9% spike, with its price surging to $2080 in response to the announcement. Over the course of the last 24 hours, ETH has shown remarkable growth, marking a 10.1% increase, according to CoinGecko.

This surge in Ethereum’s value not only demonstrates the cryptocurrency’s resilience but also its ability to regain ground in the crypto market. For some time, Bitcoin (BTC) had overshadowed Ethereum, outperforming it in terms of price and market dominance. However, the recent developments related to BlackRock’s Ethereum ETF have allowed ETH to make significant gains.

ETH’s Market Dominance Rises

Ethereum’s market dominance has exhibited a noteworthy ascent, climbing by 1.3 percentage points to reach 17%. This shift in market dynamics is not only a response to BlackRock’s ETF revelation but also a reflection of Ethereum’s growing importance and relevance in the cryptocurrency landscape. As the cryptocurrency market continues to evolve and adapt to the interests of institutional investors and established financial players, Ethereum is emerging as a prominent contender.

Decoding BlackRock’s Ethereum ETF Plan: A New Era in Cryptocurrency Investment

As BlackRock embarks on its journey into the Ethereum ETF space, a new era in cryptocurrency investment is on the horizon. Understanding the implications, motivations, and strategies behind this move is key to comprehending the evolving dynamics of the digital asset market.

The Expanding ETF Landscape

The entry of BlackRock, one of the world’s largest asset management firms, into the Ethereum ETF arena signifies the growing interest in cryptocurrency-based investment products. Examining the broader landscape of ETFs backed by digital assets and the role they play in the diversification of investment portfolios is essential.

BlackRock’s Evolving Cryptocurrency Strategy

BlackRock’s venture into Ethereum-based ETFs reflects a shift in the asset management giant’s cryptocurrency strategy. Delving into the specifics of how this strategy aligns with the evolving crypto market and BlackRock’s broader goals sheds light on its significance.

Ethereum’s Rejuvenated Role

The rally in Ethereum’s value following the BlackRock announcement signifies the cryptocurrency’s renewed prominence. Analyzing the factors that have fueled Ethereum’s resurgence and its implications for the broader cryptocurrency market offers valuable insights into the evolving market dynamics.

Key Takeaways: BlackRock’s Ethereum ETF Confirmation

- Official Announcement: BlackRock confirms its plans for a spot Ethereum ETF through the submission of a 19b-4 form filing to the SEC, signaling its entry into the cryptocurrency ETF domain.

- Cryptocurrency Market Response: Ethereum experiences significant price growth, with an 8.9% surge following the news, reflecting the cryptocurrency’s resilience and resurgence.

- Evolving Market Dynamics: Ethereum’s increasing market dominance highlights its growing relevance in the cryptocurrency landscape, marking a shift in market dynamics influenced by institutional and financial player interests.

Discussion about this post