As Bitcoin continues its fluctuation within a tight price range, hovering between $41,800 and $43,900, market observers are analyzing key indicators signalling potential upward momentum for the leading cryptocurrency. Despite a modest 0.3% decline over the past week, new data points towards several positive catalysts that could fuel a short-term rally.

Inflow Surge: BTC Investment Products Attract $702 Million

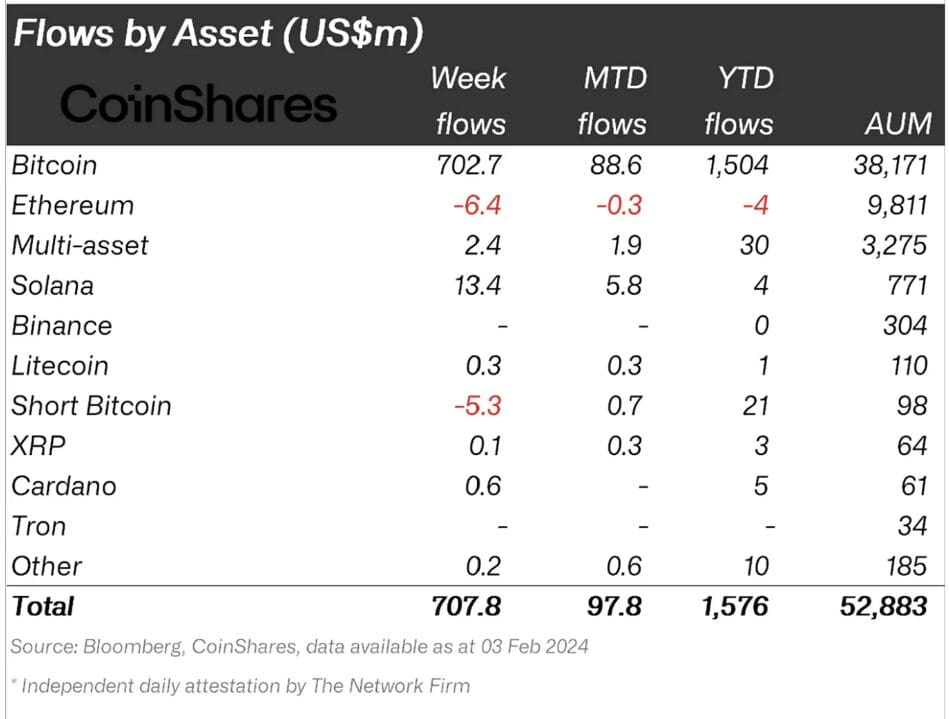

Amidst market uncertainties, Bitcoin investment products witnessed a substantial surge in inflows, with CoinShares reporting a staggering 99% share of total inflows. Notably, Bitcoin welcomed approximately $703 million in fresh inflows, driving the global assets under management in the cryptocurrency space to an impressive $53 billion.

The trend is further accentuated by the gradual slowdown in outflows from Grayscale’s GBTC ETF, marking a potential reversal in negative market sentiment that prevailed earlier.

Miner Reserves Rebound: Easing Selling Pressure

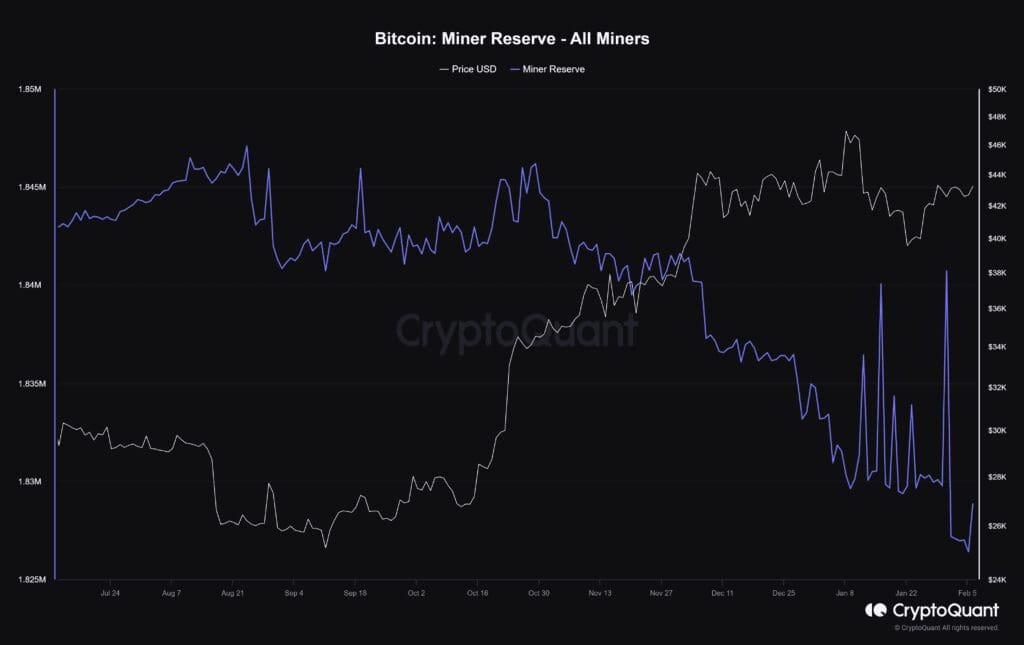

Following a period of significant sell-offs by Bitcoin miners towards the end of January, recent data indicates a reversal in this trend. The Miner Netflow Total on February 1 depicted a positive figure of over 2,400 BTC added to miners’ reserves within the past 24 hours. This uptick suggests a diminishing selling pressure from this segment of market participants.

Also Read: Bitcoin Halving: Analysts Predict a Future Where BTC Could Surpass Gold at $500K

However, while the Miner’s Position Index (MPI) remains above 1, indicating moderate selling behaviour, a sustained increase in miner reserves over the coming weeks could lead to a decline in the MPI index, signalling a shift towards holding behaviour among miners.

On-Chain Revenue Surge: Bitcoin Fees Surge by 35%

Against the backdrop of a consolidating market, on-chain revenue in Bitcoin has witnessed a notable surge, with fees escalating by 35.71% over the past week. This surge in on-chain revenue reflects an increasing demand for network utilization, indicating a potential expansion in the user base. As users demonstrate a willingness to pay higher fees for transaction inclusion, it hints at a positive market dynamic that could potentially drive momentum for Bitcoin in the charts.

Reclaiming Momentum: Bitcoin Reaches 50-EMA

As Bitcoin charts its course, reclaiming crucial technical levels becomes imperative for sustaining upward momentum. Currently, Bitcoin is eyeing the $44,500 resistance level, with its immediate support resting at $38,500.

Despite recent fluctuations, Bitcoin managed to reclaim its 50-exponential moving average (EMA) after briefly dipping to the $38,500 support on January 23. This resilience underscores the potential for Bitcoin to retest the $44,500 resistance level, provided the current bullish momentum persists.

Disclaimer: The views expressed in this article are for informational purposes only and should not be considered financial advice. Readers are advised to conduct thorough research and seek professional advice before making investment decisions.

Discussion about this post